All Categories

Featured

Think About Using the dollar formula: dollar represents Financial obligation, Earnings, Mortgage, and Education. Overall your financial debts, home loan, and college expenditures, plus your income for the number of years your family needs security (e.g., up until the youngsters run out your home), which's your protection need. Some economic professionals determine the amount you need utilizing the Human Life Worth viewpoint, which is your lifetime earnings prospective what you're making currently, and what you anticipate to gain in the future.

One method to do that is to seek business with solid Economic stamina scores. all of the following are true regarding the convertibility option under a term life insurance. 8A business that finances its own plans: Some companies can market policies from an additional insurance firm, and this can include an additional layer if you wish to change your plan or later on when your family requires a payout

Level Term Life Insurance Definition

Some firms use this on a year-to-year basis and while you can expect your prices to rise significantly, it might be worth it for your survivors. An additional means to contrast insurance coverage business is by looking at on-line client reviews. While these aren't most likely to inform you a lot about a business's economic stability, it can tell you just how easy they are to function with, and whether claims servicing is a problem.

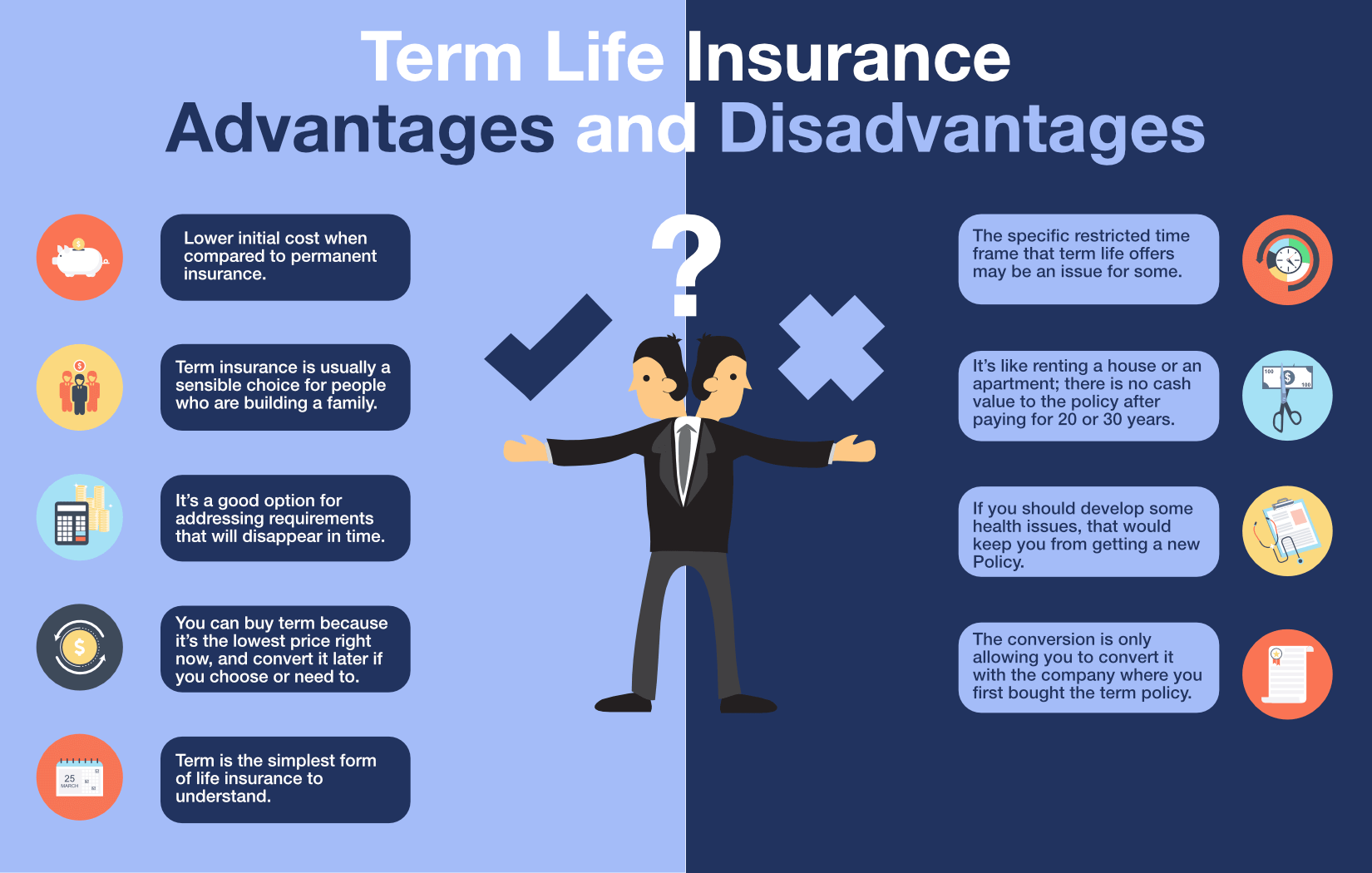

When you're more youthful, term life insurance coverage can be a straightforward method to protect your enjoyed ones. As life modifications your economic top priorities can too, so you may want to have whole life insurance for its life time coverage and added advantages that you can utilize while you're living.

Authorization is ensured regardless of your wellness. The premiums will not boost when they're set, yet they will certainly rise with age, so it's a great idea to secure them in early. Learn more about exactly how a term conversion functions.

1Term life insurance policy supplies momentary protection for a vital period of time and is generally more economical than long-term life insurance policy. what is a 30 year term life insurance. 2Term conversion standards and constraints, such as timing, may use; for instance, there may be a ten-year conversion opportunity for some items and a five-year conversion opportunity for others

3Rider Insured's Paid-Up Insurance policy Acquisition Choice in New York. There is an expense to exercise this biker. Not all getting involved policy owners are eligible for rewards.

Latest Posts

Accidental Death Insurance Vs Term Life

Return Of Premium Vs Term Life Insurance

What Is A Child Rider On Term Life Insurance