All Categories

Featured

Table of Contents

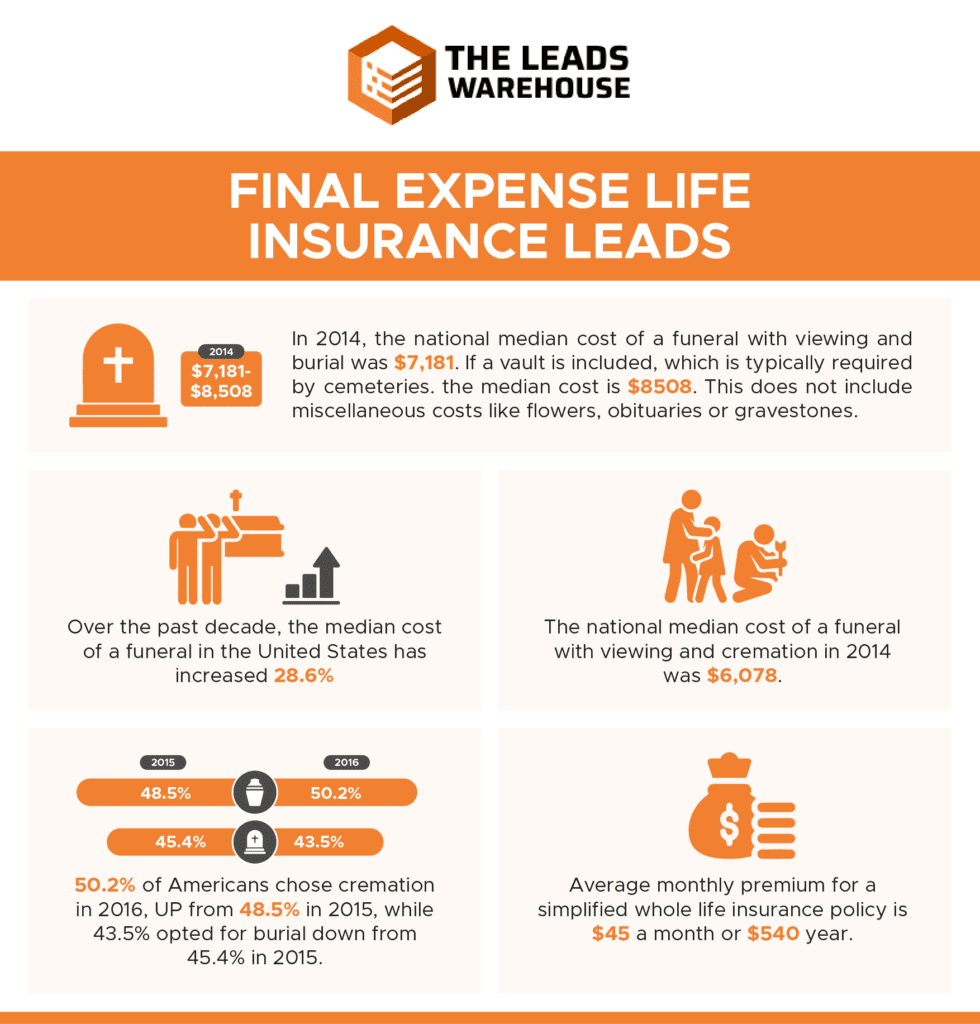

It can be uncomfortable to consider the costs that are left behind when we pass away. Failure to plan in advance for a cost might leave your household owing thousands of bucks. Oxford Life's Guarantee last expenditure entire life insurance coverage policy is a cost-effective means to aid cover funeral expenses and various other expenditures left behind.

If you decide to purchase a pre-need strategy, be sure and compare the General Price Listing (GPL) of several funeral homes before deciding that to acquire the strategy from. Below are some questions the FTC urges you to ask when thinking about prepaying for funeral services, according to its brochure, Buying for Funeral Solutions: What precisely is included in the cost? Does the cost cover just goods, like a coffin or container, or does it include other funeral solutions?

Top Burial Insurance

Not all policies coincide. Depending on what you intend to protect, some final expenditure policies may be much better for you than others. As a whole, many final cost insurance provider only provide a death benefit to your recipient. They do not offer any kind of aid with taking care of the funeral setups or cost buying funeral items.

It's usual to assume your family will use your life insurance benefits to spend for your funeral costsand they might. Those benefits are indicated to replace lost revenue and help your family pay off debtso they might or may not be used for your funeraland there can be other complications, as well.

If the insurance coverage has not been made use of and a benefit has actually not been paid during that time, you may have a choice to restore it, yet typically at a higher costs price. This sort of policy does not safeguard versus rising funeral prices. Sometimes called permanent insurance policy, this has a greater costs since the benefit does not expire in a particular timespan.

These strategies continue to be effective until the time of death, whereupon the advantage is paid completely to the marked recipient (funeral home or person). If you remain in healthiness or have only minor health concerns, you might take into consideration a clinically underwritten plan. There is normally an in-depth medical history connected with these plans, however they use the possibility for a higher optimum advantage.

Freedom Final Expense

If prices enhance and end up being higher than the policy's death advantage, your household will need to pay the distinction. A plan may have a combination of these elements. For some individuals, a clinical examination is a fantastic challenge to obtaining entire life insurance.

Medicare just covers medically needed expenses that are required for diagnosis and treatment of an illness or condition. Funeral costs are not considered medically required and therefore aren't covered by Medicare. Final cost insurance policy supplies a simple and reasonably low expense means to cover these expenditures, with policy benefits ranging from $5,000 to $20,000 or more.

Bereavement Insurance

Acquiring this coverage is an additional means to aid prepare for the future. Life insurance policy can take weeks or months to pay out, while funeral costs can begin including up quickly. Although the beneficiary has last word over how the money is used, these policies do explain the insurance policy holder's purpose that the funds be made use of for funeral and relevant prices.

While you might not take pleasure in considering it, have you ever considered just how you will reduce the financial problem on your liked ones after you're gone? is a normally cost effective opportunity you may intend to think about. We recognize that with many insurance options around, comprehending the various kinds can feel frustrating.

Unintentional survivor benefit: Gives an auxiliary advantage if the insurance holder passes away due to a mishap within a specific period. Sped up survivor benefit: Supplies a portion (or all) of the survivor benefit straight to the guaranteed when they are diagnosed with a certifying terminal disease. The amount paid out will certainly reduce the payout the beneficiaries get after the insured passes away.

Neither is the idea of leaving liked ones with unforeseen costs or financial debts after you're gone. Think about these five facts regarding last expenses and exactly how life insurance coverage can aid pay for them.

Coffins and cemetery stories are just the start. Event fees, transportation, headstones, also clergy donations In 2023, the National Funeral Supervisors Organization computed that the common expense of a funeral was $9,995.1 Funerals may be one of the most top-of-mind last cost, but lot of times, they're not the only one. Household energy bills and superior auto or mortgage may need to be paid.

You might have developed a will or estate plan without considering last expenditure prices. Just now is it emerging that last expenses can need a great deal economically from enjoyed ones. A life insurance coverage plan may make good sense and the cash advantage your recipient receives can assist cover some economic costs left behind such as each day costs or even estate tax obligations.

Selling Final Expense Insurance By Phone

Your approval is based on health info you supply or give a life insurance policy company consent to acquire. This post is given by New York Life Insurance policy Firm for informative objectives just.

Having life insurance coverage offers you peace of mind that you're economically securing the ones that matter many. Another considerable way life insurance helps your enjoyed ones is by paying for final expenditures, such as funeral expenses.

Final costs are the costs linked with interment home costs, memorial solutions and cemetery costs essentially any of the expenses connected with your death. The very best method to address this inquiry is by asking on your own if your liked ones could pay for to spend for final costs, if you were to die, expense.

You might also be able to pick a funeral home as your beneficiary for your last costs. This alternative has a number of benefits, including keeping the right to select where your service will be held.

Talk with your American Family Members Insurance Coverage representative to intend ahead and ensure you have the ideal life insurance policy protection to safeguard what matters most.

Seniors Funeral Insurance Reviews

Interest will certainly be paid from the date of fatality to date of repayment. If death results from all-natural causes, death earnings will certainly be the return of costs, and rate of interest on the premium paid will go to an annual effective price specified in the policy contract. This plan does not ensure that its profits will certainly suffice to pay for any type of particular service or product at the time of demand or that services or goods will be supplied by any certain provider.

A full statement of coverage is found only in the policy. For more details on coverage, expenses, restrictions; or to obtain coverage, get in touch with a local State Farm agent. There are limitations and conditions pertaining to repayment of benefits due to misstatements on the application. Returns are a return of premium and are based upon the real mortality, expense, and financial investment experience of the Company.

Permanent life insurance policy establishes money value that can be borrowed. Policy financings build up interest and unpaid plan car loans and passion will certainly minimize the fatality benefit and cash worth of the policy. The quantity of money value available will usually depend upon the sort of permanent plan acquired, the amount of protection bought, the size of time the plan has actually been in force and any type of superior policy loans.

Latest Posts

Accidental Death Insurance Vs Term Life

Return Of Premium Vs Term Life Insurance

What Is A Child Rider On Term Life Insurance