All Categories

Featured

Table of Contents

When life quits, the bereaved have no choice however to maintain moving. Almost promptly, family members have to manage the overwhelming logistics of death complying with the loss of an enjoyed one. This can include paying bills, splitting properties, and taking care of the funeral or cremation. Yet while fatality, like taxes, is unpreventable, it does not need to concern those left.

In addition, a full death benefit is usually offered for accidental death. A changed fatality advantage returns premium usually at 10% passion if death occurs in the initial two years and includes the most loosened up underwriting.

To underwrite this company, business count on individual health meetings or third-party data such as prescription backgrounds, scams checks, or car documents. Underwriting tele-interviews and prescription backgrounds can typically be utilized to assist the representative finish the application process. Historically firms count on telephone meetings to confirm or verify disclosure, but extra recently to boost customer experience, firms are counting on the third-party data showed over and offering instant decisions at the point of sale without the meeting.

Funeral Plan Quote

What is last expenditure insurance policy, and is it always the finest path onward? Listed below, we take a look at exactly how final expenditure insurance works and factors to think about before you get it.

However while it is defined as a plan to cover final costs, beneficiaries who obtain the death benefit are not required to use it to spend for last expenditures they can utilize it for any kind of objective they such as. That's due to the fact that last expense insurance actually comes under the category of modified entire life insurance policy or simplified problem life insurance policy, which are commonly whole life plans with smaller sized survivor benefit, usually between $2,000 and $20,000.

Our opinions are our own. Interment insurance is a life insurance coverage plan that covers end-of-life expenditures.

Burial Policies Elderly Parents

Interment insurance policy calls for no clinical examination, making it available to those with medical problems. The loss of a liked one is emotional and traumatic. Making funeral preparations and discovering a way to spend for them while regreting includes one more layer of stress and anxiety. This is where having funeral insurance, likewise known as final expenditure insurance, is available in useful.

Simplified problem life insurance needs a health and wellness assessment. If your health condition invalidates you from traditional life insurance policy, burial insurance policy might be an option. Along with less health test requirements, interment insurance coverage has a quick turnaround time for approvals. You can obtain protection within days or perhaps the exact same day you apply.

, burial insurance comes in a number of kinds. This plan is best for those with moderate to modest wellness conditions, like high blood pressure, diabetic issues, or asthma. If you don't want a clinical test yet can certify for a simplified issue policy, it is generally a much better offer than a guaranteed issue plan because you can get more insurance coverage for a less costly premium.

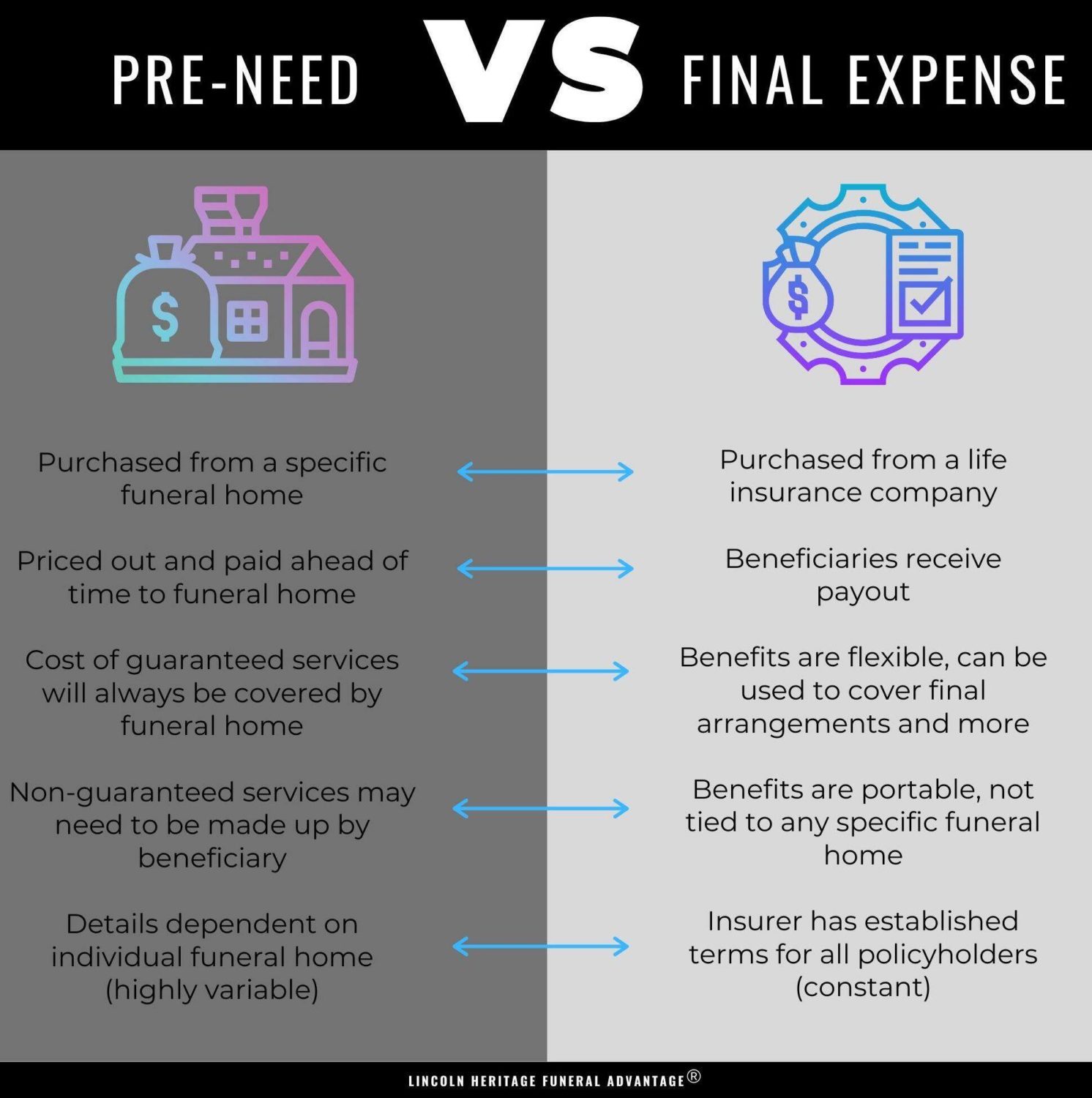

Pre-need insurance coverage is risky due to the fact that the beneficiary is the funeral home and protection is particular to the chosen funeral chapel. Must the funeral chapel go out of organization or you vacate state, you may not have coverage, and that beats the purpose of pre-planning. Furthermore, according to the AARP, the Funeral Consumers Partnership (FCA) advises versus buying pre-need.

Those are essentially burial insurance coverage policies. For assured life insurance coverage, premium estimations depend on your age, gender, where you live, and insurance coverage amount.

Interment insurance coverage supplies a simplified application for end-of-life coverage. Most insurance policy companies require you to speak to an insurance agent to use for a policy and get a quote.

The goal of living insurance is to reduce the concern on your enjoyed ones after your loss. If you have a supplementary funeral plan, your loved ones can make use of the funeral plan to deal with final expenditures and obtain an immediate disbursement from your life insurance policy to take care of the home mortgage and education and learning costs.

People that are middle-aged or older with clinical conditions may think about interment insurance coverage, as they might not receive typical policies with stricter approval standards. Furthermore, burial insurance can be useful to those without extensive savings or traditional life insurance policy coverage. Burial insurance policy differs from other sorts of insurance coverage in that it provides a lower survivor benefit, usually only adequate to cover expenditures for a funeral service and other linked costs.

Funeral Life

News & Globe Record. ExperienceAlani has actually assessed life insurance policy and family pet insurance provider and has created countless explainers on travel insurance coverage, credit score, financial obligation, and home insurance. She is enthusiastic regarding demystifying the intricacies of insurance coverage and various other individual finance subjects so that visitors have the info they require to make the very best money decisions.

Last expenditure life insurance has a number of benefits. Last cost insurance policy is frequently advised for seniors who may not certify for traditional life insurance policy due to their age.

Additionally, last cost insurance policy is beneficial for people who wish to spend for their very own funeral service. Interment and cremation services can be expensive, so final expense insurance policy offers assurance knowing that your liked ones will not have to utilize their financial savings to pay for your end-of-life arrangements. Final cost insurance coverage is not the ideal product for every person.

Aarp Burial Insurance

You can check out Principles' guide to insurance policy at various ages if you require help deciding what sort of life insurance is best for your phase in life. Obtaining entire life insurance coverage with Principles is quick and easy. Insurance coverage is readily available for seniors in between the ages of 66-85, and there's no medical examination needed.

Based upon your reactions, you'll see your approximated rate and the quantity of protection you get approved for (in between $1,000-$30,000). You can buy a plan online, and your protection begins instantaneously after paying the first costs. Your rate never ever changes, and you are covered for your entire lifetime, if you continue making the monthly settlements.

When you sell last expense insurance policy, you can give your clients with the peace of mind that comes with recognizing they and their households are prepared for the future. Prepared to learn every little thing you require to know to start marketing final cost insurance coverage efficiently?

Additionally, clients for this sort of plan might have extreme legal or criminal backgrounds. It is necessary to note that different carriers use a variety of concern ages on their guaranteed issue plans as reduced as age 40 or as high as age 80. Some will also use higher stated value, approximately $40,000, and others will enable better survivor benefit problems by boosting the rate of interest with the return of premium or reducing the number of years until a full fatality advantage is available.

Latest Posts

Accidental Death Insurance Vs Term Life

Return Of Premium Vs Term Life Insurance

What Is A Child Rider On Term Life Insurance